Is the pain over for bonds?

Bonds have traditionally been used to cushion investment portfolios from the more volatile movements more commonly experienced in equity markets, as well as generating low-risk income or yield beyond what is available in the term deposits market.

The more exciting equity markets generally get more attention, but in aggregate, the global bond markets are even larger than the global equity markets (US$123.5 trillion vs US$105.8 trillion) and have a big impact on investment portfolios. Lately, bond returns have been disappointing, with bond returns negative at the same time as equity returns due to concerns over inflationary pressures and rising interest rates.

Not so long ago, eminent financial academics were stating that with inflation having remained low for over 20 years, there was little concern about its resurgence. The twin factors of Covid-related supply chain disruption and the Ukraine war have caused inflation rise to close to 10% in many of the major global economies, changing the picture considerably. Although these relatively short-term circumstances appear to have kick-started inflation, there is also the underlying and longer-term effect of increased liquidity being supplied to the money markets by central banks through low interest rates and quantitative easing. These were policy responses to the Global Financial Crisis of 2008, but a consensus is developing that perhaps the risks of increasing the money supply to the extent that has occurred was a mistake.

Figure 1. US inflation

The chart above (Fig. 1) depicts US inflation statistics, and the picture is very similar in the Eurozone, the UK and here in New Zealand. This dramatic rise in inflation and the consequent raising of interest rates by central banks around the world as they attempt to get inflation under control has spooked bond markets. International fixed interest investments fell 8.8% in the year to June 2022 and 4.5% in the June quarter. At the same time, international equities were down 12.4% over the year and 14.9% over the quarter to June 2022. Although there are signs that inflation is peaking, the outlook is uncertain which contributes to market volatility.

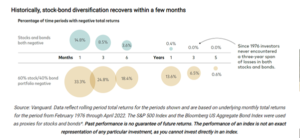

Concerns over future growth if central banks need to keep interest rates high may continue to weigh on share markets, but the positive correlation between bond and equity markets is unlikely to persist. History shows us that this effect tends to be short-lived, as shown below (Fig. 2).

Figure 2. Stock-Bond Correlation

What is the market telling us?

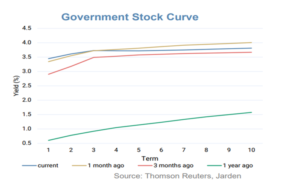

The overall yield curve of bonds has moved up compared to a year ago, as shown in the graph on the next page (Fig. 3), with yields now at much more attractive levels. However, there has been a bigger move in short-term rates, influenced by central banks tightening monetary policy, than in long rates.

Figure 3. NZ Government Bond Yield Curve

This more muted move at the long end is also factoring in the possibility of a recession. Business activity in the United States continued to contract in August with levels worse than July, which itself was the first contraction in nearly two years. Eurozone business activity is following a similar pattern. Economic growth in the UK is at a 17-month low.

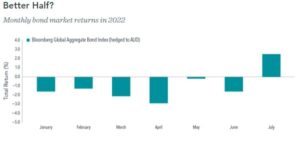

This flattening of the yield curve implies market participants are feeling quite sanguine about central banks getting inflation under control. This picture is replicated in global markets. Whether or not this proves to be correct is yet to be seen. There are some signs of bond returns improving as shown in Figure 4 below. Now that the pain of this repricing of bonds has rippled through, investors will receive higher ongoing yields, making bonds more attractive.

Figure 4. Improving Bond Returns

We cannot see into the future and ultimately, market direction will be confirmed as more data is available, but equity and bond markets certainly offer better value than they have for some time.

Ten-year US bond yields have gone from 1.51% at the beginning of 2022 to just under 3.5%. The NZ 10-year bonds now yield close to 4%, having doubled since January 2022.

The biggest challenge in such uncertain times is to do nothing. However, if your financial goals and objectives are incorporated in a well-constructed and diversified investment strategy, then remaining invested in accordance with that mandate has the highest probability of success.