Keep calm and carry on

Our Western culture values the idea of activity – being busy is a badge of honour with people listing the number of things they have scheduled in a day with pride. This is arguably the worst way to approach your investing life.

When markets are volatile and especially when they are losing value, it is tempting to do something about it and that something is often to sell to take away the pain of losing money. This behaviour is rooted in our ‘fight or flight’ instincts. In the case of investment markets, fighting isn’t possible, so we choose the flight option. If we can just access our rational minds in these moments, the data shows clearly that selling out when markets are falling is poor decision-making.

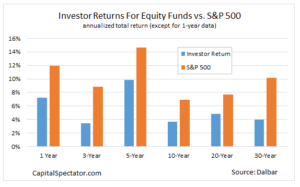

The chart below shows this over several timeframes. No matter the time period, investor returns for equity funds lag the market by a margin which exceeds any level of fees paid to access the market. Investors tend to get in the way of themselves by reacting with fear or exuberance to short-term movements in the market. Working with a trusted investment adviser can help investors to stay the course.

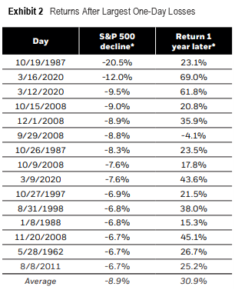

Even after large declines, which can test the mettle of the calmest investor, selling out of the market is a mistake. The table below from BlackRock using Morningstar data shows the largest one-day losses in the S&P500 since 1950 and the return one year later. In almost every case, the investor who reacted missed an excellent recovery. Over the last century, the stock market has returned about 10% per annum.

Source: BlackRock, Inc

Your portfolio should be constructed with your own personal financial goals and cashflows in mind, and should account for your individual risk tolerance, be low cost, well-diversified, and optimised for your tax situation. If this is the case, then there should be no reason to make any changes unless your circumstances change.

So, what can you do to help yourself keep calm and carry on in times of market turmoil? Talk things over with your adviser if you are concerned – two heads are better than one. Step away from the media noise to allow clear, rational thinking. Don’t check your portfolio too often. Remember that over the last century, the stock market has returned about 10% per annum and it is only by being in the market that you can capture its returns fully.

The Puritan work ethic that our capitalist system is built upon may lead you to feel you are being lazy or not diligent by doing nothing about a portfolio that is losing value but redirecting those energies to that same Puritanical idea of discipline will serve you much better. Go and perfect the golf swing, take up a new hobby, and leave the markets to work their magic of turning human ingenuity into returns on capital.