When it’s value vs. growth, history is on value’s side

Logic and history support a commitment to value stocks so investors can be positioned to take part when those shares outperform in the future.

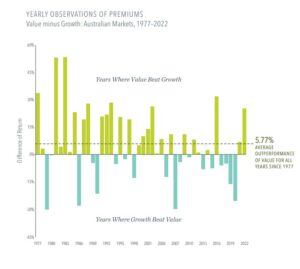

Historically, value stocks have outperformed growth stocks in

Australia, and the outperformance in a given year has often

been striking.

- Data covering nearly half a century backs up the notion that

value stocks—those with lower relative prices—have higher

expected returns. - Value premiums have often shown up quickly and in large

magnitudes. For example, while the average annual value

premium since 1977 has been 5.8%, in years when value

outperformed growth, the average premium was over 17%. - There is no evidence investors can reliably predict when

value premiums will show up. Rather, a consistent focus on

value stocks is essential to capturing these outsize value

premiums when they do appear.